How Accurate Were My 2025 NatSec Tech Predictions? A Year-End Review

More unicorns than expected, less robotics and AI spending, more acquisition reform

2025 was another great year both for startups building in the national security space and for me personally! On the startup front, national security focused startups raised more than $30B, and several, including Voyager Space and Firefly, entered the public markets. Additionally, the Department of War (DoW) launched major acquisition reform efforts, awarded contracts with the potential to be worth hundreds of millions to commercial AI labs, and dedicated billions of dollars to acquiring low cost unmanned systems across air, land, and sea.

On the personal front, I hit my goal of writing and posting at least one blog post each month, I launched a podcast, I hosted dozens of events across the country (thank you to everyone who came to one and let me know if you’d like to join events in the future), I moved to Los Angeles (although I’m still back up in the Bay Area most weeks), and I got to work with even more amazing, mission-driven entrepreneurs building businesses that will shape the future of U.S. national security in years to come.

As we near the end of the year, it’s a good time to 1) reflect on the past 12 months and 2) make some new predictions as to what is to come in 2026. In the first part of this two part series, I’ll grade my predictions from last year — then, in my next post, I’ll release a new set of predictions for 2026.

Last year, I laid out 5 predictions about NatSec x Tech for 2025:

The DoW RDT&E budget for artificial intelligence (AI) in the FY 2026 POM will more than double

DoW will double spending on VC backed startups in 2025

The DoW will announce its first program of record focused on FPV drones

The DoW will announce the launch of a new project focused on humanoid robots in collaboration with a VC-backed company

There will be major shakeups in valuations for some VC-backed NatSec startups: a) Two large NatSec startups will merge, b) one prominent NatSec startup will have a large down round, and c) three new NatSec “unicorns” will be minted.

Let’s go through each one by one:

The DoW RDT&E budget for artificial intelligence (AI) in the FY 2026 POM will more than double

Did it happen? No (but AI spend did increase)

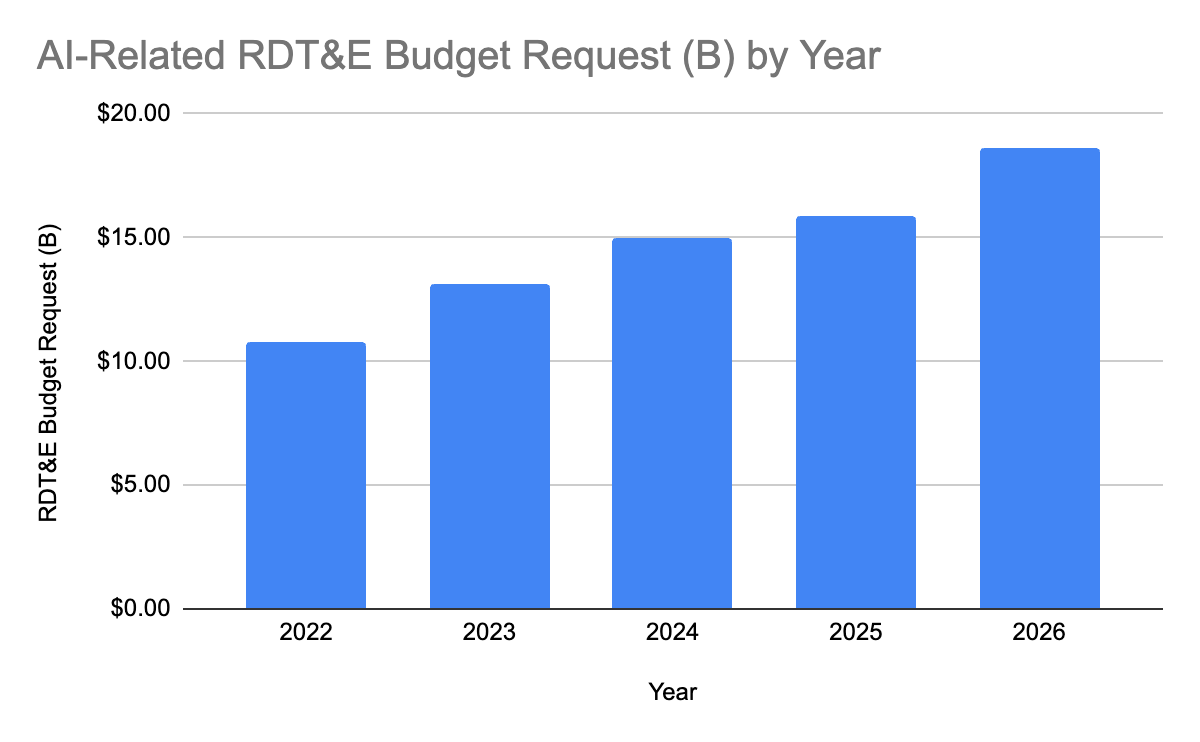

According to Obviant data, in FY25 the President’s Budget requested $15.9B for RDT&E projects that include mentions of “artificial intelligence” or “machine learning.” This year, the President’s Budget requested $18.6B for RDT&E projects that include the same key words ($17.3B from the original budget and another $1.3B from the reconciliation bill). So, while the budget request for AI-related projects certainly increased, it did not come even close to doubling.1 Much of this budget increase was driven by increases in funding for organizations like DARPA and DIU, as well as programs like ABMS, Alpha-1, and the Making, Maintaining, Supply Chain and Logistics program.

Source: Obviant

While I may have been overly optimistic about DoW’s appetite for AI in 2025, overall AI spending continued to increase, with more of the budget going towards commercial AI vendors, aligning with my prediction. CDAO awarded contracts with $200M ceilings to OpenAI, Anthropic, Google, and xAI for AI projects (although only $2M has been awarded to each company thus far). Just last week, the DoW announced the launch of Google Cloud’s Gemini for Government as the first of several frontier AI capabilities to be housed on GenAI.mil, the Department’s new AI platform (so far GenAI.mil is only available on NIPR, the DoW’s unclassified network, but there are plans to expand to SIPR, the DoW’s primary classified network for “Secret” communications). Further, CDAO’s requested budget increased by almost $500M, and DIU’s budget increased by almost $1B (both buoyed by the reconciliation bill). The services themselves are also increasing spend on AI-specific projects. For instance, just last week, the Navy announced a $448M investment in the Shipbuilding Operating System, built on top of Palantir, to accelerate the adoption of artificial intelligence and autonomy technologies across the maritime industrial base. I expect that in the year to come, we will see the DoW’s contracts with commercial AI vendors continue to grow as model access expands to more organizations and classified networks.

DoW will double spending on VC backed startups in 2025 to $10B+

Did it happen? No (but startup spend did increase)

I was overoptimistic not only about the pace of AI adoption within the DoW, but also about how quickly the DoW would award contracts to startups. According to Govini data, defense startups captured 1.3% of Pentagon contracts in the first three quarters of 2025. If that trend continues through the fourth quarter, then overall, the DoW will spend ~$5.5B of its $418B in total award obligations on defense startups. While this is slightly more than previous years, it is not nearly as much as I predicted. According to a 2024 Wall Street Journal study, VC-backed startups won ~$4B in DoW contracts in 2023, and data from SVDG suggests that VC-backed startups (including SpaceX) won ~$5B in DoW contracts in 2024 (SVDG NatSec 100 companies won ~$4B and Palantir won another $1.2B in USG contracts).

However, I suspect that in the next year or so, this trend will accelerate, particularly given new acquisition reforms which highly encourage the DoW to move quickly to procure commercial solutions. I won’t dive into the details of acquisition reform here, but if you’re curious check out this blog post and this podcast episode to learn more about how acquisition reform will make it easier for startups to sell into the DoW.

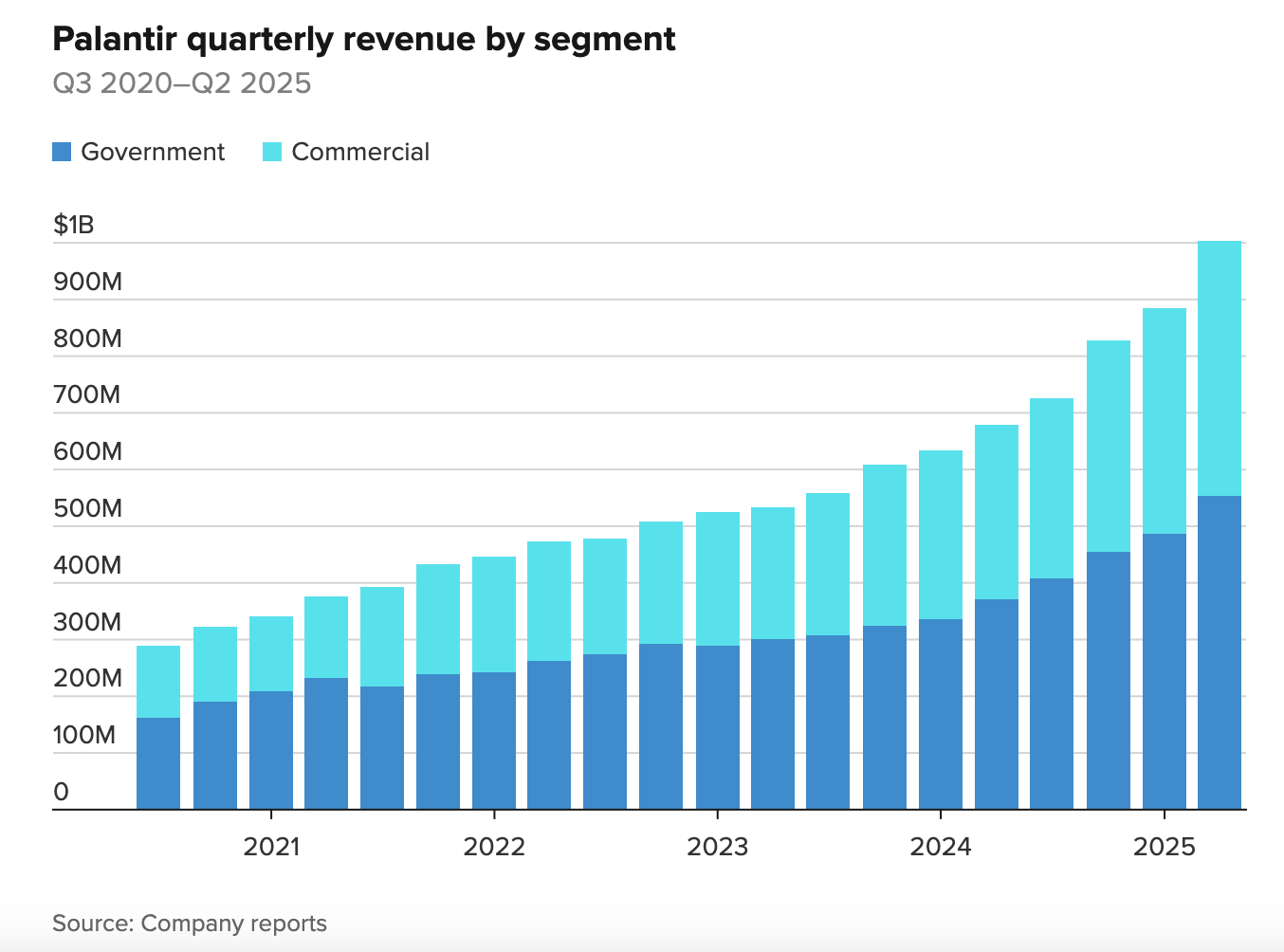

We can see early signs of acceleration within individual impactful VC-backed companies. So far this year, Palantir has reported $1.3B in USG revenue – Q2 and Q3 were both up more than 50% year over year. Assuming Palantir sees similar growth in Q4, then they are on track to do ~$1.8B in USG revenue this year – up from $1.2B last year (note that Palantir works with several U.S. government agencies, including DHS, but DoW is by far Palantir’s largest USG customer).

Similarly in 2024, Anduril doubled its revenue to $1B. According to data from Obviant, Anduril won $2.3B in contracts in 2024 and $2.6B in 2025, and currently has $2.4B in active contracts (note that most of these contracts are multi-year contracts, so Anduril does not necessarily get all the proceeds upfront).

Further, in April this year, Space Force announced that SpaceX should expect to receive $5.9B in launch contracts between 2027 and 2029, a major win for the VC-backed launch company. SpaceX CEO Elon Musk announced that SpaceX received $15B in total contracts (USG and non-USG) in 2025 (and has plans to go public in 2026, which should only accelerate its growth).

The DoW will announce its first program of record focused on FPV drones (and a VC-backed startup will win the award)

Did it happen? Yes!

In November this year, the U.S. Army announced that VC-backed drone startup Neros was one of three vendors selected as one of the primary manufacturers of FPV drones for the U.S. Army’s Purpose-Built Attritable Systems (PBAS) program.

The importance of FPV drones in modern warfare only became more apparent in 2025. In early 2025 it was reported that FPV drones caused an estimated 60-80% of casualties on the battlefield in Ukraine, and in June 2025 Ukraine conducted Operation Spiderweb, a covert drone attack in which Ukrainian forces deployed FPV drones concealed in and launched from trucks to attack five Russian air bases, destroying a number of Russia’s military aircraft. Operation Spiderweb was a major turning point in the history of drone warfare, as it demonstrated how low-cost, attritable systems like FPV drones could generate strategic effects once reserved for exquisite platforms.

U.S. government FPV adoption appears poised to accelerate in the next year. In June 2025, President Trump signed the “Unleashing American Drone Dominance” executive order, which directs federal agencies to prioritize procurement and operation of American drones and institutes policies and programs that support the development, testing, and scaling of American drone technologies. A month later SECWAR Pete Hegseth released his “Unleashing U.S. Military Drone Dominance” memo, which makes it easier for warfighters to procure low-cost, American made drones. Finally, in early December, Hegseth announced the DoW’s new Drone Dominance Program (DDP), a $1B plan to purchase 300,000+ small, lethal drones over the next two years.

The DoW will announce the launch of a new project focused on humanoid robots in collaboration with a VC-backed company

Did it happen? No

I may have been overly optimistic on this one. While there was significant VC interest in the humanoid robot sector this year (humanoid robot startups raised more than $1.5B in 2025), beyond a few small research projects, the DoW has not significantly engaged with humanoid robots. The only project I was able to find from this year was an Army xTech prize challenge related to humanoid robots (however, the project’s first phase only requires participants to submit a white paper and prizes are only $25k).

However, this could certainly change in the future. Foundation Robotics Labs, which raised more than $100M in VC-funding in 2025, has explicitly stated it plans to build humanoid robots for defense applications. The company claims they have already won $10M in government contracts (although I was not able to find any information about those contracts online). Additionally, humanoid robot startup Apptronik, which raised more than $400M in 2025, has worked extensively with the DoW, winning more than $12M in DoW contracts, according to Obviant data. Thus far, Apptronik’s work with the government has focused on its robot arm product rather than its humanoid robot product, but they could experiment with their humanoid robots in the future.

There will be major shakeups in valuations for some VC-backed NatSec startups: a) Two large NatSec startups will merge, b) one prominent NatSec startup will have a large down round, and c) three new NatSec “unicorns” will be minted.

Did it happen? a) Sorta b) Yes! c) Yes (and then some)!

First, in July this year, IonQ, a public VC-backed quantum company, acquired Capella Space, a VC-backed synthetic aperture radar company. Additionally, in May, Aerovironment merged with Blue Halo in an all stock merger. While neither Aerovironment nor Blue Halo are VC-backed, they are both smaller, more emerging players in the NatSec space. I’ll give myself a “sorta” here because the IonQ-Capella deal was an acquisition, not a merger, and Aerovironment and Blue Halo aren’t exactly VC-backed startups.

Next, Epirus, a VC-backed startup building directed energy weapons, raised a down round in March 2025. After securing $200M at a $1.35B valuation in February 2022, the company’s $240M March raise valued it at just $1.1B.

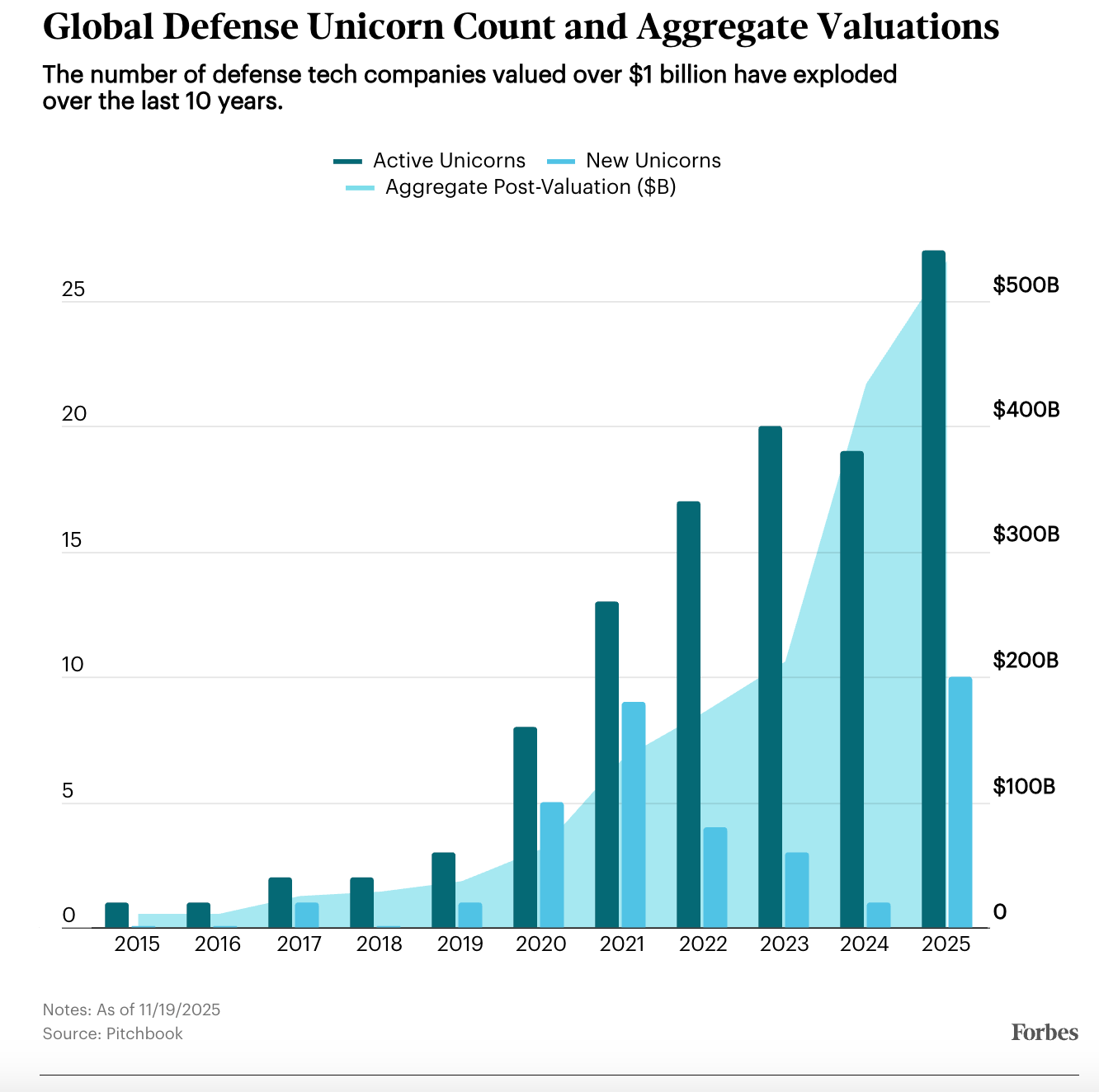

Finally, it appears I significantly underestimated the number of NatSec unicorns to emerge in 2025. While I projected just three new entrants, an astonishing eleven defense-focused startups reached unicorn status: Fortrerra, Tekever, Quantum Systems, Chaos, Castelion, Apex Space, Stoke Space, Impulse Space, K2 Space, Destinus, and Govini.

Clearly, there was more VC exuberance for national security than I anticipated, and I expect it to continue in 2026. That being said, despite investor excitement for the sector, I anticipate we will see more down rounds and acquisitions in the year to come, as some companies will struggle to scale when faced with the realities of selling into the U.S. government.

I will note that these numbers are not super precise, as they are based on a keyword search (for instance, this includes the budget for organizations like DARPA and DIU which do work with AI, but also work with a number of other technologies).

Loved the humanoid robots take! The prediction felt a bit early but the logic is totally sound. Foundation and Apptronik are both positioning themselves smartly with those DoW relationships even if the actual contracts haven't scaled yet. Ran across similar dynamics last year with autonomy platforms that took 18-24 months longer than expected to move from pilot to production. The combo of tight hardware margins and slow governmentprocurement makes timing these breakthroughs kinda impossible to predict accurately.

To what extent do you think the likelihood of acquisition is a motivator for VC activity in the space? Also, curious for your thoughts on dual use trends—will more companies be cross-positioning like Foundation Robotics, etc.?