2026 Predictions for National Security Technology

IPOs, $50B+ in VC funding, new AI strategies, Ukrainian tech transfer, and more

Last week, I reviewed my 2025 predictions for national security technology – overall, I was overly optimistic about the speed of Department of War (DoW) tech adoption and under-optimistic about investor excitement for the national security sector. That being said, 2025 was still a great year for national security startups, and I expect 2026 to be an even better year for startups looking to work with the DoW as the Department sets to work actually implementing key reforms.

This week, I’m outlining my 2026 predictions for national security technology. 2026 will truly be the year of implementing all the reforms put in place in 2025. In 2025, DoW leaders made strides towards defense acquisition reform and buying commercial: SECWAR Pete Hegseth released major reforms to the acquisition system which will encourage the Department to increase the speed at which they buy commercial technology. The 2026 NDAA codified many of these reforms into law, and the reconciliation bill (and hopefully final Appropriations bill) appropriated real money for initiatives relevant to national security technology (like the Defense Innovation Unit, which received almost $1B in additional funding in the reconciliation bill). Further, the Department announced new initiatives to purchase crucial commercial technology, like the new Drone Dominance Program which will devote $1B to purchasing small, commercially made drones. Perhaps this year my failed predictions from last year will come true (that is, that the Department will spend much more on technology from startups and on AI).

2026 will also be a crucial year for national security focused startups to truly prove that their business models and technologies can work. Over the past decade, investors have poured billions into national security startups, but few have scaled to become sustainable, profitable companies. Now is the time for startups to start delivering on the promises made to investors and customers alike: if the Department follows through with acquisition reform and mandates to buy commercial technology, then there will be tremendous opportunities for startups that remain laser focused on delivering high quality products that solve real operational needs. I expect VC enthusiasm for the national security sector to only increase as the rate of commercial tech adoption within the DoW increases and startups seek to raise additional capital to capitalize on these new opportunities.

Now, onto the predictions.

1. At least three VC backed national security tech startups will go public in 2026

While the IPO market has been slow since 2022, several notable aerospace and defense companies, including Firefly Space, Karman Holdings, and Voyager Space, went public in 2025, showing signs that the IPO market may be bouncing back (although, Firefly and Voyager are both trading well below their IPO prices).

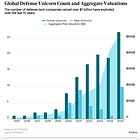

In general, companies go public when they need to 1) provide liquidity to early investors and employees and / or 2) access more money than private markets are able to offer. With close to $40B invested in national security companies in the private markets in 2025, and more national security unicorns than ever (11+ minted in this year alone), eventually, many of these companies, particularly those building capital intensive hardware, will need to turn to public markets to receive the large sums of capital they will need to truly scale. I predict that at least 3 VC backed companies relevant to national security will go public in 2026.

In mid-December, Bloomberg reported that SpaceX is preparing for a potential IPO in 2026, which could allow the company to raise more than $25B at a $1.5T valuation (SpaceX’s most recent insider share sale earlier this month valued the company at $800B, making it the world’s most valuable private company).

Other potential IPO candidates include dual use AI companies like:

OpenAI (which is rumored to be working on an IPO)

Anthropic (which is reportedly in early talks to IPO next year)

Databricks (Databricks has been on IPO watchlists for years, but just keeps raising more money in private markets, however the company says they have not ruled out a 2026 IPO if conditions are good)

Dataiku (which has reportedly already picked their banks for a potential IPO)

Cerebras (Cerebras filed for an IPO in late 2024, but in October 2025, it announced that it was withdrawing its IPO plans – however, if macroconditions change in 2026, they could once again reverse course)

Most analysts seem to believe that it is unlikely Anduril will go public this year until they lock in another large contract or two like CCA.

2. VCs will invest more than $50B in national security focused companies

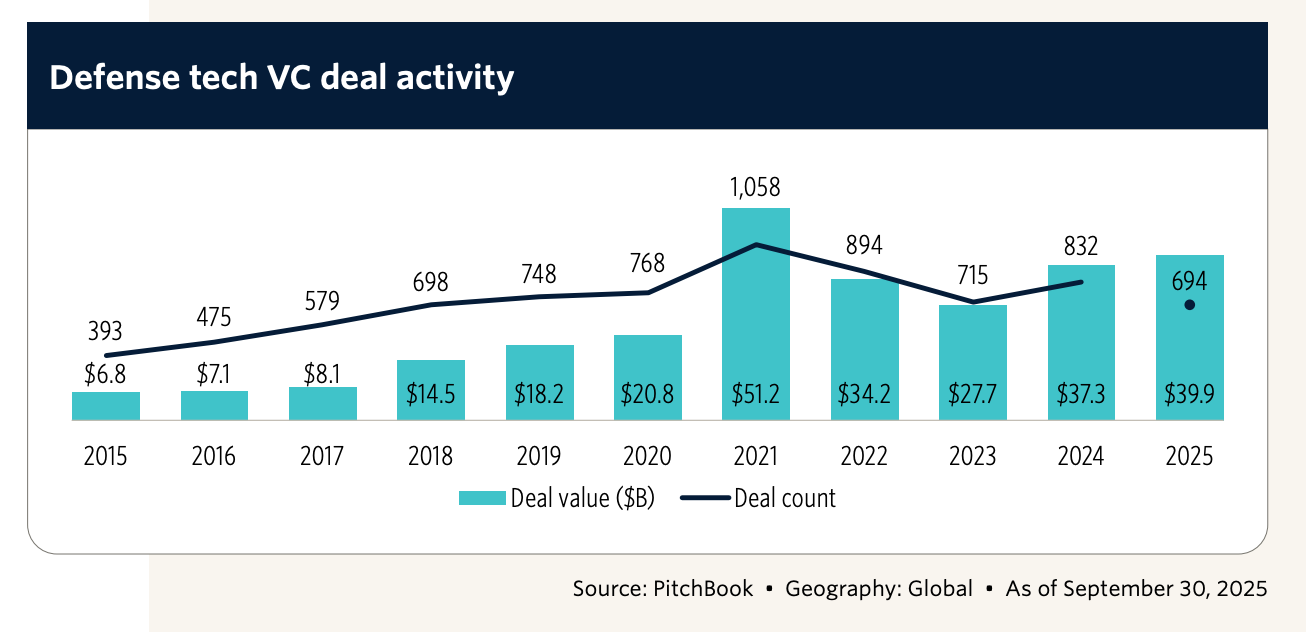

According to Pitchbook, as of September 30, 2025, venture capitalists (VCs) have invested almost $40B into national security focused companies in 2025, compared to $37.9B invested in all of 2024. Investor excitement for the sector shows no signs of slowing – 11 national security unicorns were minted in 2025 alone.

I predict that VC investment in the national security startup space will only grow in 2026, surpassing $50B, as later stage, capital intensive businesses will require more and more capital to achieve scale.

3. DoW will release a new AI strategy which will spur more adoption of commercial AI solutions within the Department

The DoW last released an AI strategy in November 2023, just one year after OpenAI released ChatGPT. Notably, the strategy does not mention generative AI or large language models (LLMs) a single time. Quite a lot has changed since 2023, with the release of reasoning models, robotics foundation models, the explosion of AI coding, the rise of reinforcement learning, and of course the widespread commercial adoption of AI chatbots like ChatGPT. Further, the DoW seems to release new AI strategies every ~2-3 years – before the 2023 strategy, the Department published earlier strategies in 2018 and 2020. As such, it seems the Department is due for a new strategy, and with it, new energy for adopting commercial AI solutions within the DoW.

Today, the Department of War’s primary entity responsible for AI policy is the Chief Digital and AI Office (CDAO). The office was recently moved under Emil Michael, the Under Secretary of Defense for Research and Engineering, after previously reporting directly to the Deputy Secretary of Defense. Earlier this month, Michael signaled that over the coming weeks and months the Department intends to aggressively scale AI initiatives across the enterprise. Reflecting this priority, CDAO’s budget for the next fiscal year increased by nearly $500 million, driven in part by the recent reconciliation bill.

These initiatives are already beginning. Just last week, the White House launched the “U.S. Tech Force,” which aims to bring early career AI talent into the government, including the DoW, to help modernize systems within the federal government. The week before, the DoW announced the launch of Google Cloud’s Gemini for Government as the first of several frontier AI capabilities to be housed on GenAI.mil, the Department’s new AI platform (so far GenAI.mil is only available on NIPR, the DoW’s unclassified network, but there are plans to expand to SIPR, the DoW’s primary classified network for “Secret” communications).

I predict that as part of this new push towards more aggressive AI adoption, the DoW will officially release a new AI strategy with a strong focus on adopting commercial generative AI products. I predict that the strategy will emphasize adopting application layer generative AI products that drive real tangible value for operators (in contrast, past strategies focused largely on data infrastructure needs rather than specific applications already offered by the private sector).

4. An American defense company will license technology from Ukraine to deliver to American warfighters

Since Russia’s 2022 invasion, Ukrainian defense firms have produced a wave of combat-proven capabilities, like small aerial drones, maritime drones, drone autonomy software, counter-drone technology, air defense systems, battle management software, electronic warfare technology, and more, hardened under live conditions and purpose-built for the realities of the modern battlefield. While the conflict in Ukraine does not align perfectly with American forces and priorities, the technology developed in Ukraine will undoubtedly be valuable to other nations (including the U.S.) that seek to remain competitive on the modern battlefield.

When the conflict began, Ukraine halted all exports of Ukrainian defense technology to other countries in order to ensure the country had the materiel it needed to defend itself against Russia. However, over the last six months, Ukraine has slowly begun easing its export restrictions for partner nations through programs like “Build with Ukraine,” which allows Ukrainian defense manufacturers to establish production lines in partner European countries and allows those countries’ militaries to access Ukrainian products. Several European countries have already announced plans to start joint production of Ukrainian defense technology – Greece has announced that it will jointly produce Ukrainian naval drones, some of which will go to the Greek Armed Forces (the rest of which will go to the Ukrainian military); the Czech company Air Team signed an agreement with a Ukrainian weapons manufacturer for the joint development and production of air target interceptors; and Norwegian defense manufacturer Kongsberg announced plans to launch production of Ukraine’s Seawolf unmanned surface drones in Poland.

I certainly expect to see more European countries seek ways to procure battle-hardened Ukrainian defense technology in the coming year, and I expect that the U.S. will also get in the action. It will be difficult for Ukrainian firms to sell directly to the U.S. government due to issues around clearance, integrating technology into existing systems, training, and shaping CONOPS and DOTMLPF to fit new technologies. Thus, I predict that at least one American firm will license battle-tested technology (likely some kind of drone or air defense technology) from Ukraine and sell it to the U.S. military, perhaps adapting the technology slightly to fit U.S. warfighter needs.

5. Golden Dome architecture will be released

Golden Dome is the Trump administration’s vision for a next-generation air and missile defense system capable of defending against strategic threats. Today, the U.S. missile defense system is primarily designed to defend against 1) rogue actors like DPRK, Iran, or terrorist organizations and 2) an accidental nuclear launch from strategic threats like PRC or Russia. For many reasons (political, economic, and technical), it is not designed to defend against strategic threats like a full scale nuclear attack from a sophisticated adversary – instead, the U.S. relies on nuclear deterrence to defend against strategic threats.

However, in January 2025, President Donald Trump signed an executive order titled The Iron Dome for America which directs the DoW to develop and deploy an architecture for a missile defense system capable of defending against strategic threats. The 2025 Reconciliation Bill provided further funding for Golden Dome (~$25B), and the 2026 National Defense Authorization Act (NDAA) officially aligned U.S. missile defense policy to align with Golden Dome and directed the DoW to release an architecture for Golden Dome. President Trump expects that Golden Dome will cost $175B and be completed by the end of his presidential term, although experts disagree on the exact cost and timeline that will be needed to field a truly capable strategic missile defense system. A number of startups and defense primes alike are gearing up to build capabilities to support this new missile defense system.

Despite Congressional and executive orders to release an architecture for the system, the DoW has not yet disclosed much publicly about a potential Golden Dome architecture. I predict that in 2026 the DoW will officially release a fleshed out architecture for Golden Dome and that commercial space startups will play a key role in developing this new system.

6. A state-sponsored hacker group will use AI agents to conduct a cyber attack that causes tangible economic damage

In November, Anthropic announced that they had detected and disrupted the first ever reported AI-orchestrated cyber espionage campaign. A Chinese state-sponsored cyber group used AI agents to target roughly thirty organizations globally, successfully penetrating several of those organizations. AI agents, equipped with open source penetration testing tools like network scanners, password crackers, and binary analysis suites connected to the agents via MCP, as well as browser use abilities, autonomously conducted network reconnaissance and attack surface mapping, discovered a SSRF vulnerability, wrote a custom payload and exploit chain, harvested and tested credentials, and then extracted sensitive data. Anthropic researchers estimate that human operators only did ~10-20% of the exploitation work – the rest was autonomously conducted by Claude agents.

As agents, and particularly coding models, continue to improve, I predict that we will see more and more cyber attacks conducted using AI agents in 2026. In particular, I expect that we will see at least one AI-enabled state-sponsored cyber attack that causes tangible economic damage in 2026 (Anthropic did not report whether there was any economic damage done during the November attack).

In order to prepare for the coming wave of AI-enabled cyber attacks, the U.S. government and enterprises must adopt similar levels of automation in our own offensive and defensive systems to remain competitive and resilient to threats posed by our adversaries.

Finally, here are a few additional “rapid fire” predictions that I crowd sourced over the past month:

The U.S. government will take a stake in at least one VC-backed company relevant to national security (could be a chip company, an AI lab, SpaceX….who knows!)

A prominent defense-only startup will launch a major commercial initiative (the defense market is only so large…)

A traditional defense prime will acquire a prominent VC-backed startup

VC backed space and defense startups will become more active in M&A markets

Augmented reality glasses or helmet will be used on the battlefield (Meta and Anduril have both made quite a lot of progress!)

New PAEs will meaningfully accelerate DoW acquisitions of commercial technology

CDAO will get a new name / re-brand

Congress will pass a compromise bill on SBIR re-authorization which will implement some (but not all) proposed reforms to the SBIR program

An American AI lab will release an open source AI model that surpasses Chinese model performance

As always, please let me know your thoughts! Do you agree with my predictions? Anything important I missed?

And of course, please reach out if you or anyone you know is building at the intersection of national security and commercial technology.

Thank you again to everyone I met this year who is working on the same mission as I am or who supported me in some way in my mission: to ensure that the U.S. and its democratic allies have the technology they need to remain competitive on the modern battlefield in order to maintain deterrence and defend freedom and democracy around the world.

Happy holidays and happy new year!

First of all, thank you for sharing all your insights and info. I was on the DIN call last week, and you are terrific.

I predict there will NOT be three defense tech IPOs in the US in 2026. The entire approach to defense innovation in the US is rigged against it. My reasoning is in the article linked below. I say this as the CEO of the largest defense tech investor group in the country with the highest level of defense tech innovation — Ukraine.

Instead of three IPOs in the US, I suggest three neoprimes will emerge from Ukraine. One of them will be mine (MITS Industries). I have an idea who the second one will be, but the third spot is open.

Here's the link to my article.

Thank you for your excellent work. If you get to Kyiv, we'd love to host you.

https://www.linkedin.com/posts/perryboyle_with-a-bit-of-help-from-the-ai-bots-i-dissect-activity-7407955729095094272-VSyF?utm_source=share&utm_medium=member_desktop&rcm=ACoAAAA9TfMBfA3mj2PPMU1DbcvF6--8DOcxn00