Satellites and SBIRs: The Strategic Signal the Space Force Must Send

How Space Force can leverage R&D contracts to signal demand to startups and VCs for future-leaning capabilities

The views expressed are those of the author, and do not necessarily reflect the official policy or position of the Department of the Air Force, the Department of Defense, or the U.S. government

In the 1920s, commercial airlines were just beginning to sprout and air power was a revolutionary new concept and capability. Early air power advocates like Major General Billy Mitchell (who was ultimately court-martialed for proving a point in the Chesapeake Bay) argued that aircraft would transform the character of warfare and aircraft carriers would project military power around the world. Early uses of the air domain were predominantly focused on intelligence, surveillance, and reconnaissance (ISR) missions. However, the Japanese bombing of Pearl Harbor made clear the changing character of war and new importance of air power in conflict. Just as Mitchell envisioned the strategic imperative of air power well in advance of WWII, a century later we find ourselves in a clear historical parallel. Until recently, space has primarily been a benign environment with a modest growth of military and commercial satellites providing a range of capabilities, most focused on ISR and communications. However, the space domain is rapidly evolving, and the need for space superiority against a rapidly emerging set of threats and competitors is raising the stakes. If the 1920s were a period of air domain experimentation, technological advancement, and commercial economic activity then today is proving to be the dawn of a new space race as nations vie for domain superiority just as new frontier defense assets and commercial opportunities arise.

Recent conflicts in the Middle East and Ukraine make one thing clear: commercial space is a force multiplier. After Russia targeted Ukrainian energy, telecommunications, and satellite communications infrastructure, limiting Ukrainian access to Internet and cellular communications, SpaceX activated Starlink in Ukraine, allowing Ukrainian civilians and troops to use the company’s commercial satellite constellation to communicate. Further, space technology startups including Capella Space, HawkEye 360, and Maxar Technologies have all provided satellite imagery to Ukrainian forces. More recently, as the U.S. Department of Defense (DoD) prepared for strikes on Iran and assessed battle damage, they likely used earth observation imagery from companies like BlackSky, Planet Labs, and Maxar to augment intelligence collected by military-owned satellites.

Historically, space was the exclusive domain of governments, militaries, and traditional defense contractors. Militaries relied on billion dollar satellites built by traditional defense contractors for navigation, communications, and intelligence collection. However, over the last two decades, innovations from companies like SpaceX have lowered the cost of launch and democratized access to space, with launch costs dropping by about 90% since 2002. As a result, a whole host of commercial space companies have emerged. These private sector companies have developed powerful technologies that can augment exquisite military space capabilities and serve as force multipliers, providing access to cheap, near real time geospatial intelligence, resilient communications networks, precise targeting, and more.

We are still in the early innings of the commercial space revolution. Space has only been a relevant warfighting domain for a few decades and has only had a meaningful commercial industry for 25 years or so. There is still much more technology development to come to unlock the full commercial and military potential of the space domain.

In order to remain competitive in an era of Great Power Competition, DoD must leverage space capabilities developed by commercial companies. Going forward, DoD cannot afford to continue relying on expensive, exquisite space systems to provide effective space dominance and missile defense. To overwhelm exquisite defense systems, our adversaries can deploy a large number of distributed capabilities to threaten high value friendly assets. Defending against this strategy will require DoD to acquire and deploy a large number of affordable and scalable defense systems, including assets on orbit, to overcome adversary capabilities, which many commercial companies are well positioned to develop.

DoD is uniquely positioned to help the American commercial space industry thrive, which will in turn strengthen U.S. national security. Many space startups rely on DoD for initial contracts and non-dillutive R&D funding. At the same time, many of the most successful commercial space companies have leveraged significant venture capital (VC) funding to fuel their growth. To build a vibrant and resilient space ecosystem, DoD funding and venture investment must work hand-in-hand, creating a pipeline from early innovation to large-scale commercial success.

As a VC investor, I’m often asked by government officials, “How can DoD most effectively signal which technologies are priorities so investors know where to focus?” The simple answer: award procurement contracts – and R&D contracts that have a clear pathway to procurement – to companies building the technologies the DoD values most. VC decision making is not rocket science: VCs want to invest in good companies they believe will make money for their LPs. Good companies are those that have built products that customers will pay for. For DoD and private investors to effectively partner to support the innovative commercial space ecosystem that America needs, DoD needs to signal their interest in companies’ technologies by providing them with real contract dollars. A consistent DoD demand signal is particularly significant for space companies, as DoD is often a space company’s first customer and DOD funding can provide non-dilutive R&D funding for capital intensive technologies like space technologies.

Today, the Space Force does not fully incentivize the private sector to invest in R&D for many of the technologies that will be crucial in future conflicts. However, Space Force can better incentivize companies to invest R&D spending more effectively by more intentionally using existing contract mechanisms like SBIR/STTR grants to signal demand for high priority technology areas. These DoD demand signals will incentivize private companies to develop the technologies DoD needs and will incentivize private investors to invest in companies developing those technologies, reducing DoD’s R&D spending burden.

If DoD can effectively use initial contracts to signal demand for high priority, forward-looking technologies to startups and VCs, all parties involved will win. Startups win because they are able to engage with their end customer, receive non-dilutive revenue, and raise VC funds to grow their business. VCs win because their portfolio companies generate customer revenue that attracts additional co-investment to de-risk the investment, while also providing clear demand signals that enable more informed investment decisions. DoD wins because they receive a pipeline of new, innovative technologies that they are able to acquire that provide needed capabilities to the warfighter, without needing to resource the entire R&D bill.

There are already success stories in which DoD was able to successfully signal demand for space technologies with contract revenue, leading to VC investment in companies. Perhaps most famously, SpaceX successfully leveraged government contracts to fund R&D, grow its business, and attract private capital. The DoD sponsored SpaceX’s first two Falcon 1 launches (both of which were failures) as part of a DARPA project, and in 2008, after SpaceX’s first successful launch (and fourth launch overall), NASA financially saved the company, which was on the verge of bankruptcy, by awarding it a $1.6B Commercial Resupply Services (CRS) contract. As we discuss in this post, other earlier stage startups like Apex, Albedo, K2, True Anomaly, and more are following in SpaceX’s footsteps, leveraging DoD contracts to raise money from private investors.

I asked my friend Nestor Levin, an active duty U.S. Space Force officer working on the Space Futures Command Task Force and as a liaison to SpaceWERX, Space Force’s innovation arm, to co-author this piece with me to discuss how the Space Force should best signal its demand to the commercial space industry to bolster the American commercial space ecosystem.

In this piece, we cover 1) background on the Space Force and the role space plays in warfare 2) the current state of Space Force technology spending 3) the current state of defense prime internal space-focused research and development (IRAD) funding 4) Space Force’s future tech priorities and how Space Force can best signal demand to the commercial space industry 5) a detailed analysis of the current state of DoD “co-investment” with private industry into the commercial space industry.

Background

The 2020 National Defense Authorization Act (NDAA) officially established the U.S. Space Force in December 2019, recognizing space as its own warfighting domain, equal to land, air, and sea. Space Force was the first new military branch established in 73 years since Congress stood up the U.S. Air Force with the 1947 National Security Act after air power had proven to serve such a central role in WWII. Today the Space Force sits under the Department of the Air Force, alongside the Air Force as a co-equal service (analogous to how the Marine Corps resides within the Department of the Navy alongside the Navy).

Mirroring the establishment of the Air Force, Congress established the Space Force based on widespread recognition that space is a national security imperative and there needed to be a military service focused solely on pursuing superiority in the space domain. Previously the Air Force had been responsible for space operations, as a second priority to air, however as space operations became more critical in modern conflicts, it became clear the U.S. needed a military branch wholly dedicated to space.

Operation Desert Storm in 1991 is widely considered to be the “first space war”; coalition forces used GPS navigation, satellite communications, and satellite reconnaissance extensively. U.S. commanders used GPS to track Iraqi units through sandstorms and conduct precise strikes against the enemy, and approximately 50% of communication networks used for command and control in Operation Desert Storm flowed through satellites. Space continued to play an increasingly important role throughout the Global War on Terror, as U.S. forces relied on satellite imagery to track insurgents, GPS to navigate remote terrain, and satellite communications to control unmanned aerial vehicles (UAVs), which became ubiquitous in counterterrorism activities.

In the last two decades, U.S. adversaries have recognized the space domain’s importance in conflict.The U.S. has long enjoyed space superiority, and, until recently, did not feel pressure to invest in technologies to protect critical space assets. However, adversaries’ newly developed asymmetric and disruptive capabilities have narrowed this gap, removing the deterring advantage the U.S. has held for so long. Russia and China both established space-centric military forces in 2015 and have both invested in counterspace capabilities (both terrestrial and on-orbit), designed to deny, degrade, or destroy U.S. space capabilities. China in particular is heavily investing in modernizing its space capabilities. Similar to the U.S., China’s space capabilities focus on communications, ISR, navigation and positioning, and early warning, while still actively developing counterspace technology.1

Current State of Space Force Tech Budget and Spending

Space Force has a $28.7B budget for FY25. Notably, more than 60% of Space Force’s budget ($18.7B) is for RDT&E2 spending – by far the largest share of any military service (compared to just 7.6% for the Army, 9.9% for the Navy, 20% for the Air Force, and 16.8% for the DoD as a whole). This significant RDT&E budget suggests that there is a real opportunity for nontraditional contractors to work with Space Force to help shape its technical vision for future programs. However, it also means that it may be more difficult for companies to transition from RDT&E to procurement contracts. This begs the question: what opportunities exist for companies to land new major procurement contracts as they transition past RDT&E?

Major spending priorities for the Space Force today include space domain awareness; missile warning and detection; resilient satellite communications; remote sensing; position, navigation, and timing (PNT); and space launch. In particular, Space Force is looking to develop systems that will be resilient in the face of peer adversaries; rather than relying on just a few expensive, exquisite space-based assets, initiatives such as the Proliferated Warfighter Space Architecture (PWSA) aim to deploy constellations of more affordable systems. This approach distributes capability, reduces vulnerability of single points of failure, and spreads risk across a resilient network.

Space Force’s five largest programs in the FY25 budget are:

Proliferated Warfighter Space Architecture ($2.5B): PWSA is developing a proliferated constellation of hundreds of space vehicles, in low-Earth orbit (LEO) intended to provide the space backbone CJADC2.3 Major primes on this program include Northrop Grumman ($966M), General Dynamics ($658M), York Space Systems ($320M), and Lockheed Martin ($298M).4

Resilient Missile Warning and Missile Tracking ($2.5B): Resilient MW/MT is developing resilient capabilities for detecting and tracking missile threats. According to Obviant data, major primes on this program include: BAE Systems ($1.2B) and Millennium Space Systems ($287M).

National Security Space Launch ($2.2B): NSSL is responsible for acquiring commercial launch services. Major primes on this program include: United Launch Alliance ($21.4B), SpaceX ($4.3B), Aerospace Corporation ($4.3B), and Peraton ($1.7B).

Next-Generation Overhead Persistent Infrared ($2.1B): OPIR aims to upgrade U.S. missile warning and missile tracking capabilities by leveraging advanced infrared sensor technology in space. Major primes on this program include: Lockheed Martin ($6.8B) and Northrop Grumman ($2.7B).

Global Positioning System III ($1.2B): GPS III is developing the next generation of positioning, navigation, and timing technology by modernizing Space Force’s GPS satellite constellation. Major primes on this program include: United Launch Services ($10.8B) and Lockheed Martin ($8.2B).

According to Obviant data, the five prime companies that have won the most Space Force contracts are:

Lockheed Martin ($26.4B)

United Launch Alliance5 ($19.6B)

SpaceX ($4.8B)

Northrop Grumman ($3.3B)

Range Generation Next6 ($1.2B)

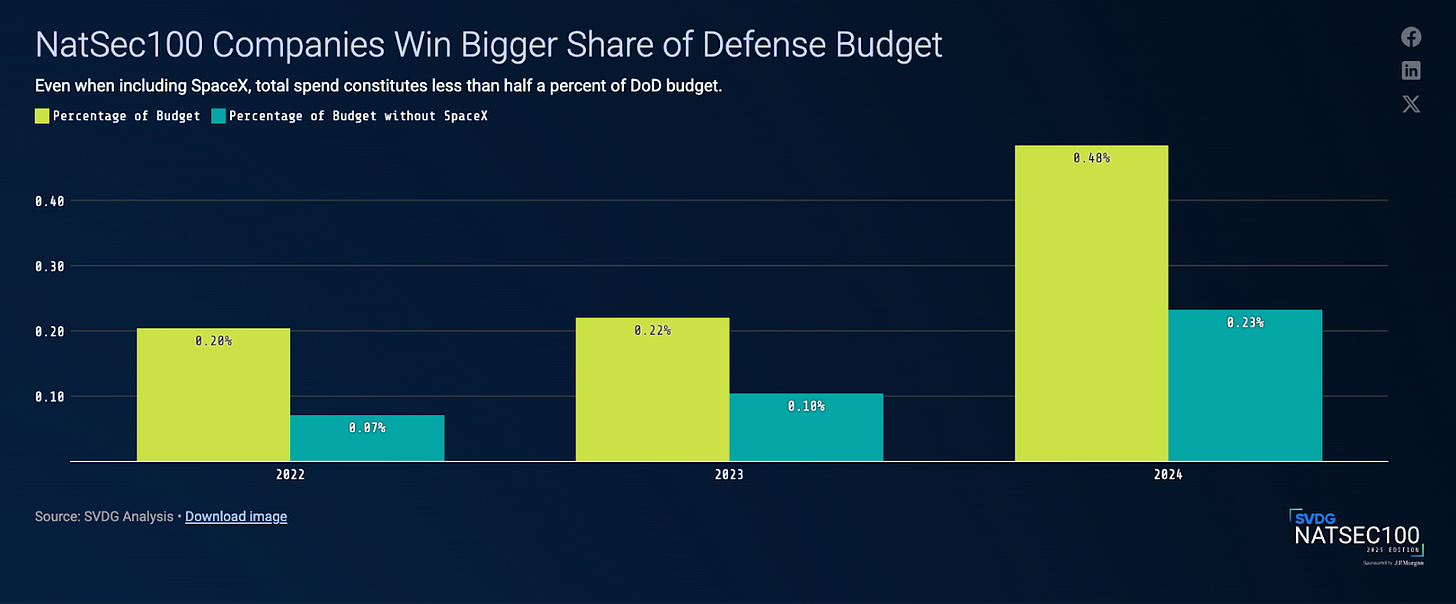

Notably, Space Force engages disproportionately more with startups than other services, and its work with startups has significantly increased over the past few years. 16.7% of the total contract revenue received by SVDG NATSEC100 startups in 2024 came from the Space Force, demonstrating strong growth since 2022 (that number jumps to 45.4% if SpaceX’s revenue is included), even though Space Force’s budget is significantly smaller than other services’ budgets.

Current State of the Commercial Space Industry

Since 2009, $349.8B has been invested across 2,228 startups building in the space domain. These startups build everything from earth observation satellites, to communications satellites, to launch vehicles, to in-space servicing platforms, to in-space manufacturing, and much more. As with much of the VC-backed startup industry, there was significant hype around investing in space in 2020 and 2021, and a number of space startups (particularly earth observation startups like BlackSky) went public via SPAC7 during that time period. Since interest rates started rising in 2022, much of the hype around space startups has cooled, and many public space companies like Planet Labs are trading well below their SPAC / IPO prices.

However, there is still significant investor interest in space startups building realistic, scaleable, and valuable business models, and in the first quarter of 2025, startups raised $4.3B from investors. As VC investment into space startups becomes more disciplined, now is the time for Space Force to be diligent in signalling demand to investors and startups, as investors will be looking to invest in startups with clear, scalable business models servicing real customer demand.

Future Space Force Priorities

While technologies like space launch, PNT, and remote sensing will remain important for the Space Force going forward, they are relatively mature technologies, with large commercial markets. Given recent shifts in adversary capabilities and Space Force doctrine and policy towards space as a warfighting domain, in order to stay competitive and maintain deterrence, Space Force must invest in a new host of technologies including rendezvous proximity operations (RPO), autonomy on-orbit, increased SDA capability and volume, in-space data processing, in-space mobility, software-defined receivers, open-architecture optical communications terminals, high-delta V propulsion, orbital warfare capabilities, among others. Many of these capabilities will be developed by commercial space startups rather than legacy defense primes, and as such will require Space Force to rethink the way it works with vendors and signals demand.

In this section, we discuss how Space Force can best signal demand and incentivize companies to develop future-looking technologies. First, we survey the current state of defense primes’ Independent Research and Development (IRAD) spending and argue that primes are not incentivized to invest IRAD in truly future looking technologies. Second, we discuss how startups can best leverage both R&D contracts like SBIR/STTRs and private capital investment to develop truly future-looking technologies. Third, we analyze existing successful space startups to illustrate a model for how the Space Force should more intentionally award R&D contracts to incentivize startups and VCs alike to invest in high priority, future-looking technology areas.

Current Trends in Independent Research and Development (IRAD)

As outlined above, today, the Space Force procures the vast majority of its technology from traditional defense primes. However, defense primes are not properly incentivized to invest in truly future-looking technologies, opening up opportunities for startups to compete in these consequential technology areas. In this sub-section, we discuss 1) why the existing Independent Research and Development (IRAD) spending process does not incentivize innovation, 2) which technology areas current IRAD spending goes to and, 3) which future-looking technology areas the primes are underinvesting in where startups should look to compete.

Unlike most commercial companies, defense contractors typically receive “cost-plus” contracts, in which the government pays for all contractor costs and provides an additional fee or profit margin, regardless of the project's final cost. In contrast, IRAD is R&D spending that a company undertakes using its own funds, without direct government sponsorship, and often leads to the future technologies defense primes sell to the DoD. Notably, DoD reimburses defense primes for their IRAD as long as the IRAD spending is clearly aligned with DoD interests specifically advancing technologies and capabilities relevant for national defense.

This reimbursement mechanism disincentivizes primes from investing IRAD in developing risky future-looking technologies, ultimately limiting the capabilities Space Force will have access to in the future. Due to penalties and loss of reimbursement for misaligning IRAD costs, primes are incentivized to use the National Defense Strategy, specific modernization priorities, or existing programs as their key S&T investment drivers, rather than investing in more future-looking technology that may not yet have large program dollars appropriated. Defense primes have contributed, on average across the industry, between 12-14% of their total IRAD budgets towards space-based research and development projects. Overall, defense primes spend about 2% of their revenue on IRAD today, down from 3.5% in the 1990s.

Figures 1A and 1B show how IRAD funding has been allocated among different space technology areas during the last five years. Space Access (namely launch and satellite design) and Space Enablers (supporting technologies including materiel, manufacturing, software, mod/sim, etc.) at $871M and $486M, respectively, show the strongest investment signals, followed by Satellite Communications at $405M. The high level of investment in these areas likely supports the SDA PWSA tranches, evolved strategic satcom (successor to AEHF8) for military satellite communications, space mobility & logistics, tactically responsive space (TacRS), rocket cargo, next-gen OPIR, and other major program opportunities.

Notably, “Command, Control, & Satellite Ops”, “Space Control/Space Situational Awareness”, and “Space Resilience," at $156M, $101M, and $38M respectively, are on the lower end of this spectrum. Another area for growth is testing infrastructure, such as buses capable of supporting repeated developmental test cycles for experimental payloads seeking flight heritage. This capability will become increasingly important with the impending retirement of the ISS, creating a gap in orbital testbeds. This relatively lower level of spend suggests that traditional defense primes are not prioritizing these sectors, opening them up to disruption by small businesses and non-traditional market entrants.

Existing incentive structures cause primes to underinvest in these segments, as IRAD investment attention is typically skewed toward technical capabilities that can be incorporated into existing programs or included in upcoming new programs. This bias reinforces the status quo and deprioritizes more forward-leaning innovation. Moreover, this dynamic highlights the persistent disconnect between perception and reality within the defense ecosystem. Major acquisition programs, which are often extensions or upgrades of legacy systems, command multi-billion-dollar budgets. In contrast, truly disruptive, next-generation technologies are frequently relegated to the margins as “experiments” or one-off demonstrations, rather than positioned for sustained integration or scale.

The venture-backed companies analyzed in the next section are primarily building products in these areas of lower IRAD investment. While they may not have large dedicated program dollars today, these technology areas will become increasingly important given recent adversary developments and shifts in Space Force doctrine and policy towards space as a warfighting domain, indicating early TRL9 investment into these relatively underinvested markets has ample room to grow.

Unlike primes, startups have maximum incentive to reinvest most of their funding towards internal product development. Primes, under pressure to deliver quarterly revenue milestones and satisfy shareholder dividend demands, have limited capacity to reinvest in dedicated IRAD, which they primarily allocate to immediate programs of record. The less certainty there is in securing a contract for a new program, the greater the risk, and the less inclined prime contractors are to invest in forward-looking, game-changing capabilities. This difference in incentives creates a window of opportunity for startups to take the lead in developing the next generation of technologies that the Space Force will need for the future of conflict.

Startups and SBIRs

Startups, which tend to focus on more future-looking technology that may not be affiliated with specific existing programs, are not able to receive reimbursement for IRAD costs. Instead, on the startup side of the industry, the Space Force’s primary mechanism for subsidizing R&D is through the Small Business Administration's SBIR/STTR allocations,10 rather than IRAD reimbursement. Originally envisaged as an economic development tool in the 1980s, various government agencies have adopted SBIR/STTR as a means to fund development of forward-looking capabilities. SpaceWERX, the Space Force unit managing the service’s SBIR/STTR awards, has an annual budget of $460M.

In recent years, SBIR/STTRs have become a go to revenue source for many early stage startups in the industry seeking non-dilutive funding to augment their capital raises. However, similar to IRAD reimbursement for defense primes, the current state of the SBIR/STTR program does not always incentivize small businesses to develop high priority technologies and scalable business models. According to the Defense Innovation Board’s Scaling Nontraditional Defense Innovation report, published in January 2025, the current innovation processes of the DoD (including the Space Force) are headed in the right direction, but are far from perfect. The report highlights the challenge of “stitching” together disparate funding mechanisms, contracting vehicles, organizations, and mission needs into a smooth transition pipeline. Interviewees report that the government contracting system often isolates innovative companies from commercial markets and venture capital by branding them as “SBIR Mills,” while offering limited support through inconsistent Technical Points of Contact and poorly defined transition paths. They highlight structural shortcomings, including a lack of planning for post-prototype production, misaligned incentives for prime integrators, and rigid requirements processes, that collectively stall the adoption of emerging technologies.11

According to the 2025 SVDG NATSEC 100 report, while innovation is occurring at breakneck pace, the widescale adoption and proliferation of these capabilities into the force remains a bottleneck. Over the past three years, the companies discussed in the report (many of which are space companies) have attracted a total of $28.6B in federal awards (including $1.8B OTAs and $199M in SBIRs) compared to $70.15B in private investment. This slow adoption of technology relative to private capital investment begs the question: how sustainable is the current rate of private investment into national security focused customers, and what is the Space Force’s role?

Without a clear demand signal, or a cradle to grave pipeline from experimentation to production, startups face many points of disconnect and friction while attempting to scale deployment with DoD customers, leading to the frequently described “valley of death.” The current JCIDS12 process takes roughly two years to validate requirements, during which high-risk, high-reward R&D projects can be difficult to justify, as there may be no formal program in the POM13 for those projects. More open-ended, performance-based, and non-prescriptive requirements are needed. Furthermore, the POM cycle (how everything in military acquisitions is budgeted) requires a multi-year lead time (planning, programming, budgeting, and executing). Throw in venture-raise timelines (12-24 months between raises), debt financing/loans for manufacturing scaling, and SBIR/CSO/OTA14 opportunities at various cycles of the fiscal year, and the environment for developing and delivering cutting-edge capability to DoD quickly becomes increasingly challenging.

For any company pursuing SBIRs/STTRs, a myth to dispel is that SBIRs directly lead to “transition” to a program office. Data shows that the transition rate for SBIRs to programs is less than 6%. SpaceWERX can only award RDT&E dollars, a separate color of money than procurement/production contracts that Space Systems Command program offices, Rapid Capabilities Office, and Space Development Agency award. A SBIR is a mechanism to de-risk IRAD spending in areas of interest to the government but is not a pathway to procurement contracts in a vacuum. All of the companies analyzed here have won STRATFIs, allowing for a holistic comparison through the entire SpaceWERX pipeline.

Despite the challenges in the current SBIR/STTR system, some startups have been able to effectively leverage SBIR/STTRs to fund high value R&D, developing technologies crucial for the future of the Space Force. Data for some high growth startups in the industry reveals interesting patterns, supporting the thesis that startups should seek SBIR/STTRs as a means to offset engineering risk and subsidize their own corporate IRAD, and also as a mechanism to prepare for larger capital raises and government contracts. Successful startups, while delivering against their SBIR contracts, also proactively engage requirements owners and congressional aides early, and have a strong understanding of which office has what authority, funding, color of money, need, and mission.

Space Ecosystem Public-Private Co-investment Analysis

In this section, we analyze a group of 10 selected space startups who have passed major investment and product milestones and have an extensive SBIR/STTR performance history in order to present a “co-investment” model for how VC and DoD investments can work in tandem to develop new, innovative space capabilities at scale. We analyze the ratio of government R&D contract funding to private capital raised for each company, assessing how public investment compares to private market interest. Additionally, we examine the timeline of contract awards and fundraising rounds to understand how government wins influence or accelerate subsequent private investment. We argue that by gaining traction from Space Force customers through SBIRs as an “IRAD subsidy,” startups can build credibility and reach technical milestones to keep momentum to raise private capita. The startups discussed provide a range of services including specialized and commoditized bus manufacturing, in-space mobility, re-entry capsules, alt-PNT services, space situational awareness, and remote sensing. Software-exclusive and hardware component provider companies were not included. To be clear, this comparison does NOT take into account various sources of funding from DIU, DARPA, or other channels, nor is it reflective of any certain “success” metric.

The charts below exclude SpaceWERX Phase 1s, but the percentages incorporate the sum of SBIR/STTR awards raised.

Albedo

Albedo won two Phase IIs before and after their Series A funding tied to sensor payload development, before winning their STRATFI. Given the engineering difficulty to operate in VLEO, non-dilutive funding for component payload development, with a STRATFI that provides AFRL with data insights into imagery from a novel orbit to inform future missions, were important milestones in demonstrating defense need.

Apex Space

Apex Space won three Phase IIs and a TACFI for component and bus design configurations between their Series A and B, followed by a STRATFI to develop and deliver complete buses for various missions ahead of their recent Series C.

Impulse

Impulse won two Phase IIs following their Series A towards tactically responsive space needs followed by a STRATFI for hosting government payloads on upcoming missions.

K2 won six Phase IIs for adopting their bus design towards defense mission sets leading to a STRATFI for delivering a fully configured mega-class bus.

LeoLabs

LeoLabs began receiving SBIR grants only after their Series A, with radar arrays based on space force SDA operator needs, culminating in a STRATFI post Series-B for a high end phased array radar. The lengthy time to receive awards and funding is partially attributed to the logistical complexity of developing a global network of phased array radars for space situational awareness before the 2021 inflection in capital markets towards space investment and before the Space Force was established.

Starfish

Starfish received six Phase IIs to develop their Cephalopod software suite, Nautilus capture mechanism, CETACEAN navigation system, and Otter servicing vehicle, before receiving a STRATFI for integration and capability delivery prior to their Series A1 raise.

Varda

Varda Space Industries received a Phase II for potential hypersonic development testing and applications heading into their Series A, with a Phase II centered around high-delta v propulsion. Their STRATFI in 2023 directly grew from their first Phase II.

Turion

Turion received five Phase IIs after consecutive Series A raises to develop operationally relevant on-orbit servicing, sensor optimization, and SDA data capture capabilities, before receiving a STRATFI pre-Series A1 for delivering their droid satellites with an integrated hardware/software suite based on their Phase II pipeline.

True Anomaly

True Anomaly received two Phase IIs post Series A and B for their command and control software and bus design, before winning a STRATFI for their Jackal autonomous satellite ahead of Space Safari’s Victus Haze tacRS demonstration mission, prior to their Series C.

Xona Space Systems

Xona Space Systems won three Phase IIs to deliver dedicated, assured alt-PNT capability, followed by a recently announced STRATFI to develop and demonstrate its initial Pulsar smallsat constellation for precise PNT.

Takeaways

This data shows that successful companies utilize VC and DoD investments in tandem, providing a model startups, VCs, and DoD should follow in order to develop new, innovative space capabilities at scale. The data suggests that space startups should raise a relatively small (less than $10M) initial round of VC funding before receiving any meaningful DoD investment. Space startups should use that initial private seed funding to de-risk the business by building an initial team and refining the product and technology vision, potentially by building early prototypes, and formulating a roadmap for how they plan to break into the Military Addressable Market.

With a team and technology in place, startups can go on to win some small government R&D contracts. Startups can then use that government funding as validation, demonstrating early customer demand to investors, reducing market risk, and positioning themselves to secure larger funding rounds. 6 of the 10 startups analyzed received DoD investment between their first and second rounds of VC funding, and all but one received government funding between their second and third rounds of VC funding. This time period after receiving the first couple R&D contracts is also the window startups should start forming relationships with their customers. The Space Force is not a single entity, but a conglomerate of numerous organizations with their own missions, funding, colors of money, and risk appetite. Identifying the “who’s who” of the Space Force and their relationship to one another can be daunting, but is vital during the prototyping period.

This model is a win-win-win for everyone involved: startups win because they are able to engage with their end customer, receive non-dilutive revenue, and raise VC funds to grow their business. VCs win because their portfolio companies generate customer revenue that attracts additional co-investment to de-risk the investment, while also providing clear demand signals that enable more informed investment decisions. DoD wins because they receive a pipeline of new, innovative technologies that they are able to acquire that provide needed capabilities to the warfighter, without needing to resource the entire R&D bill.

In order to perpetuate and scale this model of using SBIR/STTR grants to signal demand to early stage space startups, the Space Force should continue to be intentional as it awards grants to companies, prioritizing companies with the potential to raise VC money and scale that are tackling critical future defense needs often overlooked by traditional prime contractor IRAD spending. Commercial and non-traditional market entrants will not fully replace primes, but instead will augment the Space Force’s current acquisitions pipeline. A stronger co-investment partnership with private investment firms serves as a force multiplier, given that the value of private science and technology investment exceeds government funding by an order of magnitude.

The Space Force must clarify high priority capabilities and not just technology needs of interest, conveying a concrete demand signal to derisk investor appetite, especially as VC and private equity investors become more interested in deploying capital more conservatively and towards scaling. Furthermore, the Space Force must incentivize companies outside of traditional program of record pathways (i.e. OTAs) and follow-through past demonstrations, committing sustained dollars towards proven technology.

The Space Force needs to continually re-evaluate its metrics of success and focus on reducing two key areas of friction:

The early TRL landscape, by sourcing promising early stage companies effectively and seeding their long-term success (Seed to Series A). This can be accomplished through consolidated and prioritized S&T guidance linking directly to future operating concepts, wargaming validation, streamlined experimentation, and well-understood future operating environments.

The more mature suite of companies who have secured a STRATFI (Series B to C). These companies must have a clearer path towards procurement. A STRATFI on its own is not the destination, but a launchpad towards future contracts. STRATFIs are a relatively new mechanism, with most period-of-performances not maturing until 2025-2029. The question “what comes after?” is still open and depends on the Space Force’s ability to close the gap on prototyping to production. This is where technology pull matters, and can only come from new Requirements from the service and the Objective Force Design, which Space Futures Command should influence.

Several recent policy developments also reflect the data shown above and can help solve structural issues. The INNOVATE Act,15 a bill introduced in March 2025, seeks to comprehensively reform the SBIR/STTR authority to allow greater flexibility and new constraints to enable stronger VC and DoD alignment. The annual SBIR/STTR budget stems from a set aside of DoD’s annual extramural R&D budgets. INNOVATE has several important provisions:

First, it increases the annual allocation for SBIR/STTRs from 3.25% to 3.45% of the extramural R&DTE budget, increasing flexibility for more frequent strategic awards.

Second, the budget increase and reallocation of STTR dollars to SBIR create the conditions for a 0.25% budget allocation to “Strategic Breakthrough Awards” of up to $30M. SpaceWERX, the owner of the Space Force SBIR/STTR budget, would be able to hypothetically increase STRATFI SBIRs from $15M to $30M. SpaceWERX could, in theory, exercise greater flexibility by awarding multiple sequential Phase II contracts, such as two consecutive STRATFIs instead of a single one. This approach offers startups more predictable government support, helping to signal consistency to private investors, manage expectations over time, and better align with the multi-stage nature of venture capital funding cycles.16

Third, the legislation works to reduce the prevalence of “SBIR mills” and improve the ratio of SBIR dollars to private investment. Over time, in order to continue receiving SBIRs, companies must demonstrate a minimum ratio of 1:1 SBIR to non-SBIR revenue, with clearer commercialization requirements.

Fourth, a small business can not exceed $50M in SBIR grants within a 4 year time frame. Based on the Table 1 snapshot of companies, there is ample room for companies to leverage SBIRs for strategic technology development as IRAD, with a reasonable cap.

Combined, these policy shifts could increase a company’s probability of landing a production contracts like OTAs, especially if a company engages key DoD and congressional stakeholders with an early enough lead-time prior to the conclusion of a STRATFI’s period of performance, in order to advocate for funding in the next POM cycle. To accelerate this from a RDT&E standpoint, SpaceWERX should focus on more targeted SBIR awards and scaling winners, with less emphasis on “seeding” the ecosystem.

Conclusion

This analysis primarily focuses on the R&D phase of a company’s evolution. Certainly much more can and should be written about improving transition pathways from R&D contracts to procurement contracts (and much has already been written on this subject). However, analysis of R&D contracts is still necessary, as without a strong R&D pipeline with production in mind, a bottleneck will remain.

To unlock the next generation of space capabilities, Space Force must deliberately reshape its partnership model with the commercial space ecosystem. That means going beyond rhetorical support for innovation and adopting deliberate, actionable procurement strategies that signal long-term demand to both startups and venture investors. Existing mechanisms like SBIR/STTR (including TACFIs and STRATFIs) must be more strategically deployed, not as isolated experiments, but as the foundation of a structured technology transition pipeline. This will require better alignment between technologists, acquisition authorities, and operators to define non-prescriptive requirements, reduce barriers to procurement, and provide consistent customer engagement. As venture investors look to deploy capital in an increasingly disciplined market, predictable DoD demand signals will act as catalysts for co-investment.

Startups and VCs also have a role to play in improving the state of commercial space innovation within the DoD. Startups must engage closely with their future end users as they develop their products to ensure they are truly building for high priority warfighter needs. Further, startups need to understand that SBIR/STTRs alone are not a viable transition pathway to larger scale production contracts. Rather, SBIR/STTRs should be viewed as a way to help de-risk initial product R&D, but at the same time startups must proactively engage requirements owners and congressional aides early, and have a strong understanding of which office has what authority, funding, color of money, need, and mission.

VC firms need to have realistic expectations for portfolio companies selling into Space Force and other military services and should not pressure their portfolio companies to seek an exit or liquidity prematurely, just because DoD contracting takes longer than they realize. When making dual-use investment decisions, VC firms need to understand real Space Force future needs and invest in companies that fill capability gaps Space Force will face in future conflicts. This comes from an understanding of which capabilities Space Force is likely to source from non-traditionals vs primes, relative capability timelines, architectural decision implications, potential adversary threats, and authorities given to empower acquisition officers.

The next decade will define whether the United States can sustain its leadership in space. Commercial companies are no longer auxiliary – they are essential to delivering resilient, cutting-edge capabilities. But to fully realize this potential, the Space Force must evolve into an agile partner that sends clear demand signals through prototype to procurement contracts, not just research grants. By embracing co-investment with venture capital, prioritizing scalable solutions, and streamlining the path from prototype to production, the Space Force can build a stronger, more resilient ecosystem. The time to act is now. Decisions made in the coming years will shape America’s ability to prevail in the contested space domain for decades to come.

As always, please reach out if you or anyone you know is building at the intersection of national security and commercial technologies. And please reach out if you want to further discuss the ideas expressed in this piece or the world of NatSec + tech + startups. Please let us know your thoughts! We know this is a quickly changing space as conflicts, policies, and technologies evolve.

For more on the state of China’s space capabilities, see Payload’s report Mapping Out China’s Space Capabilities.

RDT&E = research, development, technology, and evaluation

CJADC2 stands for “Combined Joint All-Domain Command and Control” and is a DoD-wide initiative designed to improve the integration and interoperability of U.S. military forces across all domains and services. The goal is to provide a unified, cohesive approach to military operations, enabling faster and more efficient decision-making and response times. For more, see the DoD’s Summary of the Joint All-Domain Command and Control Strategy.

ULA is a joint venture between Lockheed Martin and Boeing.

Range Generation Next is a joint vehicle between RTX and General Dynamics.

SPAC = Special Purpose Acquisition Company. A SPAC is a publicly traded shell company formed to raise capital through an initial public offering (IPO) with the purpose of acquiring or merging with an existing private company, thereby taking it public without the traditional IPO process. In 2020/2021, there was a SPAC boom that saw an unprecedented surge in blank-check IPOs, fueled by abundant liquidity, speculative investor enthusiasm, and the promise of faster, less burdensome paths to public markets for high-growth companies (SPACs require less regulatory oversight than traditional IPOs). Since interest rates started to rise in 2022, about ⅓ of all companies that SPAC’d in 2020/2021 have since de-SPAC’d.

AEHF = Advanced Extremely High Frequency System. AEHF is a joint service satellite communications system.

SBIR/STTR = Small Business Innovation Research / Small Business Technology Transfer. SBIR/STTR grants are R&D grants the DoD awards to small businesses conducting innovative technology research.

A few particularly telling quotes from the report:

“Government contracts brands companies as a ‘SBIR Mill,’ slows them down, and drags them away from our commercial market and VC capital.”

“Technical Points of Contact (TPOCs) do not have the time, capacity, or job mandate to shepherd introductions with end-users and purchasers. Even worse, they are often changed, restarting the relationships with non-traditional vendors.”

“The requirements process does not account for opportunities.”

“Small contracts requiring some R&D to fit a maturing commercial technology to a DoD mission do not have a place in the POM, falling outside the purview of laboratories and field-level services contracts.”

“There is no planning, nor budgeting, for production contracts immediately following the prototyping phase. ‘Innovation’ is effectively funded expecting failure.

“For prime integrators, the contract ‘small business set asides’ are not actively managed nor valued by the USG, creating little incentive to be good at leveraging them.”

JCIDS = Joint Capabilities Integration and Development System. The JCIDs process is the U.S. Department of Defense's process for identifying, validating, and prioritizing military capability requirements, particularly for weapon systems

POM = Program Objective Memorandum. The POM is a key document within the DoD’s Planning, Programming, Budgeting, and Execution (PPBE) cycle, outlining how each military service and defense agency plans to allocate resources over a five-year period to meet strategic goals.

INNOVATE = Investing in National Next-Generation Opportunities for Venture Acceleration and Technological Excellence.

We recommend reading the Hoover Institute’s report “The Warfighter’s Pipeline” for more detailed analysis.

The best article on this subject. Everyone in the industry should read this. One of the featured companies is getting a SBIR Phase 3 most likely because of this article. One small quibble, the Space Development Agency (SDA) used a spiral development model where each subsequent phase (tranche) is a prototype building on the capability of the previous one, and thus uses RDT&E funds rather than procurement funds for its major efforts.